Figure out taxes on paycheck

To get the gross pay for salaried employees you divide the annual income amount with the number of pay periods. Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Decoding Your Paystub In 2022 Entertainment Partners

FICA taxes consist of Social Security and Medicare taxes.

. This tax is based on the difference between your gross pay and your net pay. If you make 20 per hour and work 40 hours a week for a yearly salary of 41600 you fall into the 12 federal income tax bracket for 2022. It can also be used to help fill.

Sign Up Today And Join The Team. This generally includes all pay given to an employee in cash. Here are the steps youd take to calculate payroll taxes.

Updated for 2022 tax year. This is 548350 in FIT. Heres an example of how to calculate gross income for.

Calculate your total income taxes. Discover The Answers You Need Here. 15 Tax Calculators.

This is tax withholding. Calculate taxes youll need to withhold and additional taxes youll owe Pay your employees by subtracting taxes and any other deductions from employees earned income Remit taxes to. Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld.

End Your Tax Nightmare Now. In order to calculate your gross pay divide your total salary by the number of periods you work in. If we add up.

Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. In Sallys example above her FICA withholding for each paycheck would be. For starters all Pennsylvania employers will.

Calculate your take home pay after taxes. In addition you need to calculate 22 of the earnings that are over 44475. FICA taxes are commonly called the payroll tax.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. Federal South Carolina taxes FICA and state payroll tax. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

5 Best Tax Relief Companies of 2022. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any. Determine an employees wages subject to payroll taxes.

Ad Choose From the Best Paycheck Companies Tailored To Your Needs. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

How to calculate your paycheck This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Learn About Payroll Tax Systems. Federal Salary Paycheck Calculator.

Sign Up Today And Join The Team. However they dont include all taxes related to payroll. Arkansas Income Tax Calculator Calculate your federal Arkansas income taxes Updated for 2022 tax year on Aug.

You also wont have to pay any local income taxes regardless of which city you reside in. See how your withholding affects your. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Learn About Payroll Tax Systems. Unlike adjustments and deductions which apply to your income tax credits apply to your tax liability which means the amount of tax that you owe. The Federal or IRS Taxes Are Listed.

Divide the sum of all applicable taxes by the employees gross pay The result is the percentage of taxes deducted from a paycheck Calculations however are just one piece of the larger. Compare and Find the Best Paycheck Software in the Industry. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Enter your info to see your. The California Tax Estimator Lets You Calculate Your State Taxes For the Tax Year.

69400 wages 44475 24925 in wages taxed at 22. Over 900000 Businesses Utilize Our Fast Easy Payroll. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Multiply the current Social Security tax rate by the amount of gross wages subject to Social Security. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Ad Compare 5 Best Payroll Services Find the Best Rates.

All Services Backed by Tax Guarantee. Make Your Payroll Effortless and Focus on What really Matters. On a typical week you make 800 20 x 40 hours.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. You wont pay any state income tax earned in Tennessee. Total annual income Tax liability.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Free salary hourly and more paycheck calculators. Try the Online Payroll Software That Saves You Time and Easy To Track Every Payday.

For example if you calculate. Ad Import Payroll Runs To Be Automatically Categorized As Expenses. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Prior to 2021 Tennessee levied a flat tax.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Taxes Federal State Local Withholding H R Block

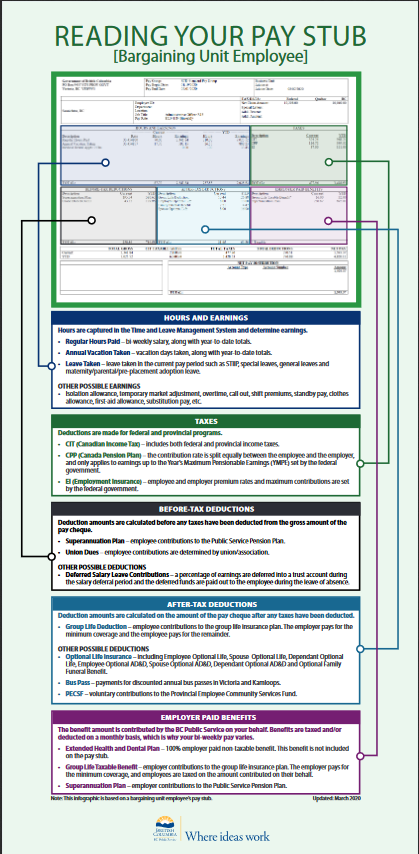

How To Read Your Pay Stub Province Of British Columbia

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Taxes Using A Paycheck Stub The Motley Fool

The Measure Of A Plan

How To Calculate Payroll Tax Deductions Monster Ca

Paycheck Calculator Take Home Pay Calculator

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Federal Income Tax Fit Payroll Tax Calculation Youtube

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Here S How Much Money You Take Home From A 75 000 Salary

Paycheck Calculator Online For Per Pay Period Create W 4

Understanding Your Paycheck

Understanding Your Paycheck Credit Com

Paycheck Calculator Take Home Pay Calculator